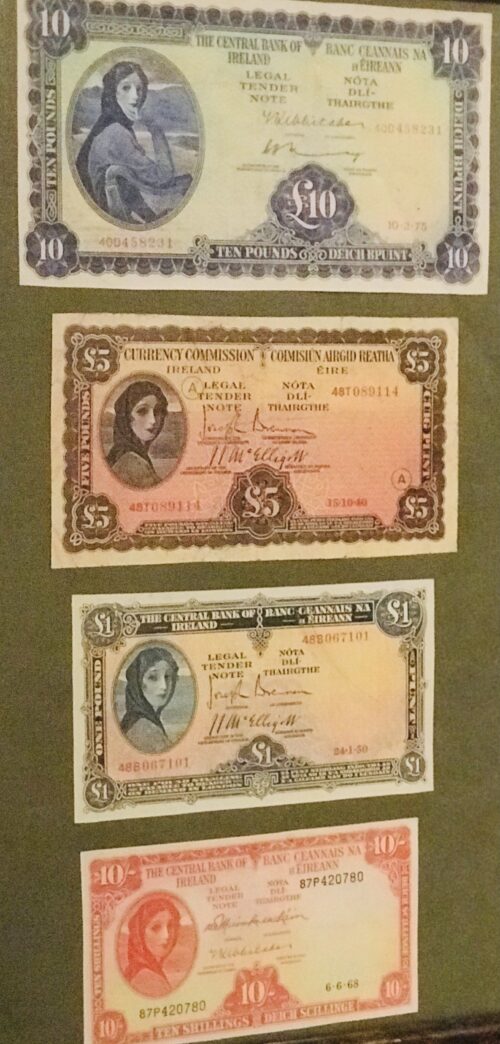

Lovely reproduction of vintage Irish Bank Notes - the old £10,£5 & £1 pound notes which existed until the arrival of the Euro.

45cm x 35cm Limerick

The

Irish Free State, subsequently known as

Ireland, resolved in the mid-1920s to design its own

coins and

banknotes. Upon issuing the new currency, the Free State government pegged its value to the

pound sterling. The

Currency Act, 1927 was passed as a basis for creating banknotes and the "Saorstát pound" (later the "

Irish pound") as the "

standard unit of value." The

legal tender notes issued under this act began circulating on 10 September 1928.

When the

Irish Free State came into existence in 1922, three categories of

banknote were in circulation. These consisted of notes issued by the

Bank of England, the

British Treasury, and six Irish banks that were

chartered to issue notes. Only British Treasury notes were

legal tender within the state. The issuing of banknotes by multiple private institutions was an everyday aspect of banking in

Great Britain and

Ireland at the time and remains so in

Northern Ireland and

Scotland.

A banking commission was created in 1926, the

Commission of Inquiry into Banking and the Issue of Notes,

[1] to determine what changes were necessary relating to banking and banknote issue in the new state. The commission was chaired by Professor

Henry Parker Willis of

Columbia University who was Director of Research of the

Federal Reserve Board in the

United States. The commission's

terms of reference were:

- "To consider and to report to the Minister for Finance what changes, if any, in the law relative to banking and note issue are necessary or desirable, regard being had to the altered circumstances arising from the establishment of Saorstát Éireann."

The commission's report of January 1927 recommended creating a currency for the state that would be directly backed and fixed to the

pound sterling in the

United Kingdom on a one-for-one basis.

This new currency, the "Saorstát pound," was overseen by the politically independent

Currency Commission created by the Currency Act, 1927. Because the notes of the commission were backed by the pound sterling, they could be presented at the London Agency of the Currency Commission and exchanged with the pound sterling, without charge or commission, on a one-for-one basis.

A second banking commission, the

Commission of Inquiry into Banking, Currency and Credit, was created in November 1934 to inquire into creating a

central bank. The majority report of August 1938 recommended creating a central bank with enhanced powers and functions. This resulted in the creation of the

Central Bank of Ireland, but it would take three decades before the bank would have all the rights and functions associated with a central bank.

As per the usual convention for banknote issue, banknotes are and were issued in the name of the Currency Commission or Central Bank existing at printing.

Before the advent of the

euro, three series of legal tender notes were issued; these are referred to as "Series A," "Series B," and "Series C," respectively. A series of notes known as the "Consolidated Banknotes" were issued but were not legal tender.

The Currency Commission devised the "Series A" notes. They were printed by

Waterlow and Sons, Limited, London which was acquired by

De La Rue. The commission created an advisory committee that determined the theme and design of the notes. Notes were in the denominations of 10/-, £1, £5, £10, £20, £50, and £100. Each note has a portrait of

Lady Lavery, the wife of the artist

Sir John Lavery, who was commissioned to design this feature. The original oil on canvas painting of Lady Lavery, titled

Portrait of Lady Lavery as Kathleen Ni Houlihan (1927), is displayed at the

National Gallery of Ireland on loan from the

Central Bank of Ireland.

The theme on the reverse of the notes is the

rivers of Ireland, which are depicted as heads taken from

the Custom House,

Dublin. Rivers in both the

Irish Free State and

Northern Ireland were chosen. Each note also contains a watermark of the

Head of Erin.

1929–1953: Consolidated banknotes

This series of banknotes were never legal tender . They were equivalent to "

promissory notes" that continue to be issued by some banks in the

United Kingdom. Notes were issued as a transitional measure for the eight "Shareholding Banks" of the Currency Commission:

Bank of Ireland,

Hibernian Bank,

Munster & Leinster Bank,

National Bank,

Northern Bank,

Provincial Bank of Ireland,

Royal Bank of Ireland, and

Ulster Bank. These notes were first issued between 6 May and 10 June 1929 under the arrangement that the banks withdraw previous notes and refrain from issuing further notes. The consolidated notes were only issued by the Currency Commission. The last notes were printed in 1941. The notes were officially withdrawn on 31 December 1953.

The front of each note depicted a man ploughing a field with two horses. They are referred to as the "Ploughman Notes." The notes' denominations and the back designs were; £1 (

Custom House,

Dublin), £5 (St. Patrick's Bridge,

Cork), £10 (Currency Commission Building, Foster Place, Dublin), £20 (

Rock of Cashel,

County Tipperary), £50 (

Croagh Patrick,

County Mayo), and £100 (

Killiney Bay,

County Dublin). The name of the issuing Shareholding Bank also varied, along with the corresponding authorising signature.

1976–1993: Series B banknotes

The Central Bank of Ireland commissioned the "Series B" notes. They were designed and brought into circulation between 1976 and 1982. Servicon, an Irish design company, designed the £1, £5, £10, £20, £50, and £100 denominations. The £100 note was never issued or circulated. This is the only series of Irish banknotes without a note of this denomination.

The theme of these notes was the

history of Ireland. Each note featured the portrait of a historical figure. The Lady Lavery portrait, from Series A, was retained as a watermark.

1992–2001: Series C banknotes

This series of notes called "Series C" was the outcome of a limited competition, held in 1991, to which nine

Irish artists were invited. The winner and designer of the series was

Robert Ballagh. This series of notes had denominations of £5, £10, £20, £50 and £100. No

Irish pound note was designed because the currency had a

coin of this value since 1990. This series was introduced at short notice, with the £20 note being the first to be issued, following widespread forgery of the Series B £20 note. The last banknote of the Series C issue was a £50 note that was issued in 2001.

The theme for this series was people who contributed to the formation of modern

Ireland. To this effect, it includes politicians, a literary figure, and a religious figure. The political figures do not include anyone directly associated with the

Irish War of Independence, which eventually led to the creation of the

Irish Free State.